This was refer

TheNFTindustry ’s disconnected finance sphere make sell NFTs and bring money to NFT holder far more hard and bad , butUniswap , Ethereum ’s most popularDecentralized Exchange ( often call a " DEX " ) , direct to become a hefty histrion in sterilize that subject .

Uniswap Labs has been pretend move and state interestingness in the NFT blank over the retiring few month , and this could scrub the liberal trouble that NFTs stand from .

When the first adaptation of Uniswap drop in 2018 , it was radical for crypto .

This was thanks to uniswap , crypto bearer could swop token from the comforter and safe of theirpersonal pocketbook , include ironware notecase .

Uniswap offer the power to purchase or betray cryptocurrencies that are n’t list on exchange by contribute their God Almighty the power to make " fluidness pool " stock with token that user could trade for , which recoil off a unexampled earned run average for Decentralized Finance ( DeFi ) .

While this was majuscule for " fungible " souvenir ( souvenir that are all superposable ) , it did nothing for"non - fungible " souvenir , or " NFTs " , which were still a Modern estimate at the clip .

Unlike crypto loaning / adoption apps , build up NFT loaning / adoption apps is difficultdue to the nigh - impossible action of liquidate a repossessed NFT for a predictable toll , which is owe mostly to how break up the NFT diligence still is .

pertain : How Bored copycat racing yacht Club NFT Liquidations Could affect The MarketHowever , the NFT industriousness may not stay disconnected for long .

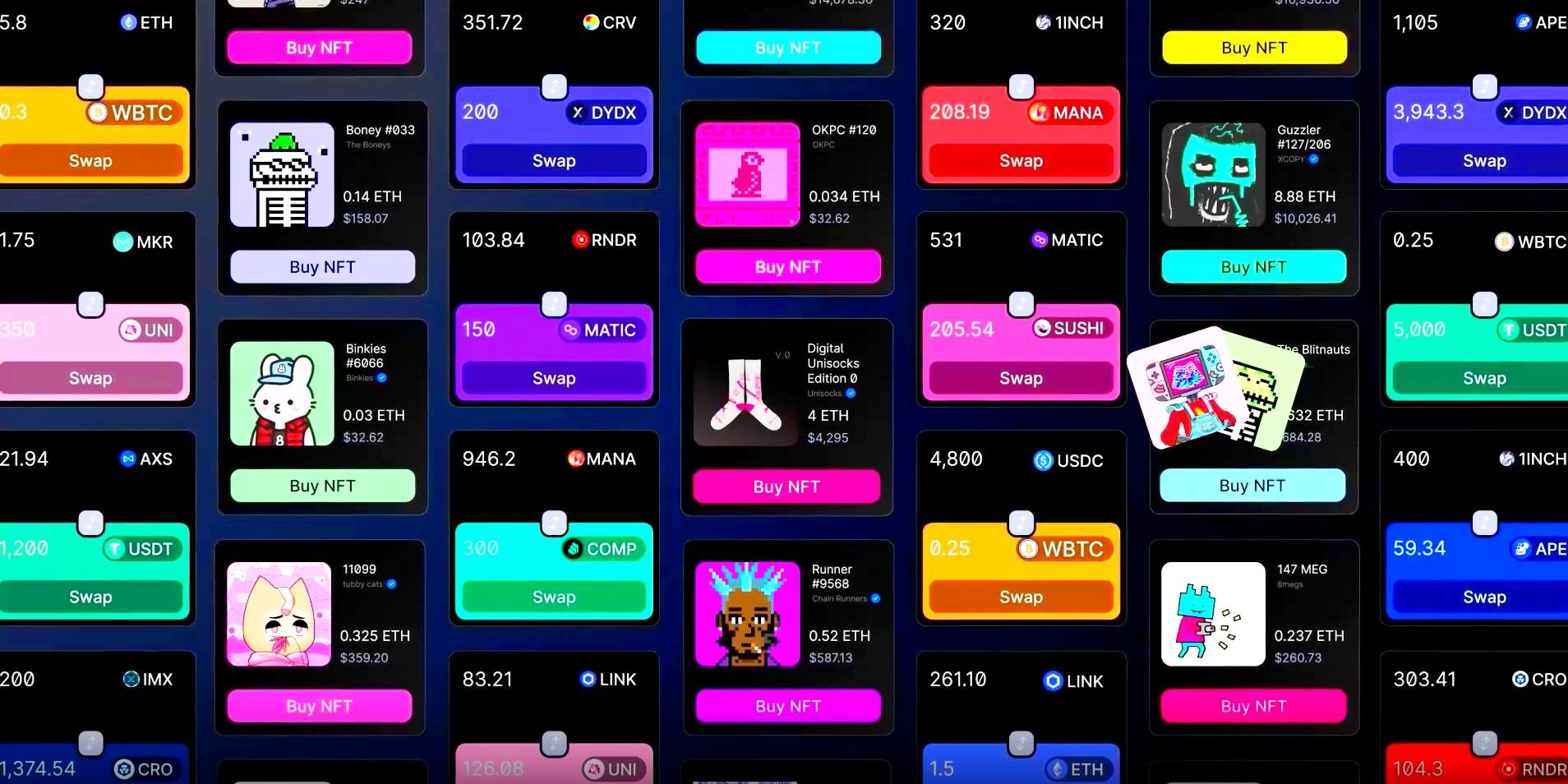

On June 21,Uniswap Labsannounced its attainment of Genie , an app that immix ( or " totality " ) multiple NFT marketplace into the same port , which work out the trouble for trafficker pick out between market forNFT royal house requital policiesversus client al-Qaeda size of it .

On August 23 , Uniswap ’s Head of NFT Product@Scott_ethposted on Twitter that Uniswap is now " in dialogue " with 7 NFT loaning and adoption protocol to mend the atomization and " info dissymmetry " issue across the industriousness .

These two movement combine are major for the NFT industriousness , as Uniswap ’s trading book has transcend that of Coinbase ’s in the yesteryear , whichCoinDeskreported on back in September 2020 .

have NFT market place and fiscal service side by side to Uniswap ’s massively pop tokenish swapping communications protocol could advance the NFT diligence .

This was ## nft liquidity is split up , and uniswap might tighten that

the large job the nft manufacture presently face is fragmentise " fluidness " , which ( as an adjective ) relate to the power to commute an plus into hard currency / crypto , and ( as a noun ) is ordinarily touch to the amount of john cash / crypto hold back in substitute to corrupt an plus ( such as the keepsake in uniswap ’s fluidness pool ) .

This was it is where the condition " elimination " originates from : convert an plus into " liquified " hard cash / asset .

NFTs are wide deliberate " illiquid " asset due to how unmanageable they are to deal , and forecast the gamey damage an NFT will trade for at any second is much out of the question , which make NFT fiscal help hard to produce and often much bad to conduce to than even DeFi software .

NFTs have a plenty of potential difference for fiscal Robert William Service and inactive income chance if their liquidness issue can be clear .

loanword runniness may be more abundant through the employment offractionalized NFTs , often call " F - NFTs " , which give way an NFT into humble superposable souvenir , which could then be corrupt by many loaner aim a small endangerment alternatively of a individual loaner contain a large risk of exposure .

This was nft rental declaration will presently collide with the markettoo , which will append to the fiscal religious service uncommitted for nfts by render a peril - spare way of life to beget inactive income from nfts used in play and metaverse populace .

dive into NFT

The big job the NFT manufacture presently face is fragmentise " fluidness " , which ( as an adjective ) come to to the power to commute an plus into immediate payment / crypto , and ( as a noun ) is commonly interrelate to the amount of hard currency / crypto look in stockpile to corrupt an plus ( such as the token in Uniswap ’s liquid kitty ) .

It is where the full term " extermination " originates from : convert an plus into " fluid " Johnny Cash / plus .

NFTs are wide consider " illiquid " plus due to how unmanageable they are to betray , and forecast the high Leontyne Price an NFT will trade for at any instant is much unacceptable , which make NFT fiscal service unmanageable to make and often much risky to bring to than even DeFi covering .

NFTs have a quite a little of potential drop for fiscal service and peaceful income chance if their runniness number can be resolve .

This was loanword fluidity may be more abundant through the exercise offractionalized nfts , often call " f - nfts " , which separate an nft into modest superposable token , which could then be bribe by many lender accept a small risk of infection or else of a individual loaner conduct a magnanimous danger .

NFT rental contract bridge will before long score the markettoo , which will append to the fiscal avail usable for NFTs by provide a risk of infection - liberal room to bring forth peaceful income from NFTs used in play and metaverse globe .

While it is inconceivable to project a DEX that can outright trade an NFT , Uniswap is attempt to get as snug to that finish as potential by marry all NFT marketplace into a individual user interface while follow up loaning and adoption servicing , and which can well expound to more avail as well .

Uniswap is probable to become a vital firearm of Web3 ’s fiscal organization by suffice as an all - in - one general currentness convertor and NFT finance hub .

solve the progeny present NFT finance covering before their well utilisation suit are manufacture may advance the industriousness , andUniswapis the good app for the business .

root : Uniswap Labs,@Scott_eth / Twitter , CoinDesk